Everything you need in one place for life after graduation

Interest-free graduate overdraft

An arranged overdraft allows you to go overdrawn up to an agreed limit. So, if payday is still a long way off and you’re short of cash, an arranged overdraft could help to cover an unplanned expense. Think of it as a short-term safety net.

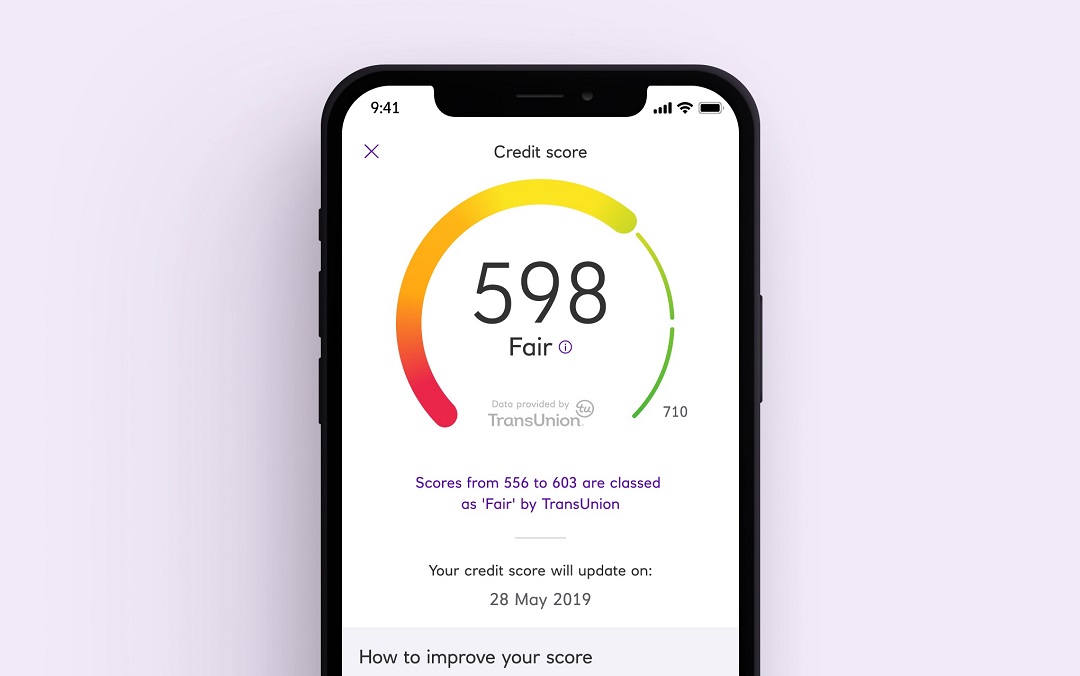

Overdrafts are a way of borrowing money and you're responsible for repayments if you decide to use one. If you're unable to repay what is owed, you could impact your credit score, which most lenders use to decide whether they'll lend to you.

Interest-free limits

- Interest-free overdraft of up to £3,250 (for your first year after graduation).

- Year 2: £2,250 interest-free limit.

- Year 3: £1,250 interest-free limit

- Get handy text alerts to help you stay on top.

Applying is really quick

- Applying through Online Banking takes around 5 minutes.

- Get an instant decision if you bank online with us.

Access your funds, fast, once approved

- If your overdraft is approved, it’ll normally be available the next working day. But there might be a few exceptions to be aware of.

What are the overdraft costs?

Graduate arranged overdrafts are only available to eligible UK residents who have a NatWest Graduate bank account. Subject to lending criteria. Over 18s only.

Renters Insurance

Insuring your belongings is a wise move, especially during your student years. Take a look at Renters insurance to see if it suits your needs.

Saving for a home

It's never too early to start planning for your future home. If you're dreaming of your own place, we could help you start your journey.

Want to find out more about savings?

The 2024 NatWest Savings Index shows trends in savings knowledge, attitudes and habits across the UK.

Learn how to start your savings journey and create good habits today.

Common questions about our Graduate account

Important documents to read

We do our best to ensure everyone is aware of their account terms and conditions, please take some time to review, print and/or save a copy of these.