This rate is available on loans between £7,500 and £14,950. Other loan amounts are available at alternative rates. Our rates depend on your circumstances, loan amount and term and may differ from the Representative APR.

To apply for a loan online, you must be 18+ and a UK resident. Had a current account with us for 3+ months? You could borrow up to £50,000. Otherwise, if you don't have a current account, you could borrow up to £35,000.

Borrowing terms for a wedding loan

Wedding loan calculator

Representative Example

£10,000

60 Months

£195.24

£11,714.40

6.6

6.60

The rate you pay depends on your circumstances, loan amount and term and may differ from the Representative APR. We will never offer you a rate exceeding 29.9% p.a. (fixed), regardless of loan size. This means you're not guaranteed to get the rate you see in the calculator.

What is APR?

Take a break, with a loan repayment holiday

When you apply for a loan, based on your circumstances, we might give you the option to defer your first repayment.

- It's only available at the start of your loan term.

- You can defer your first loan repayment for a 3 month period.

- If this option is available, we'll show the details of your repayment holiday at the quote stage of your application.

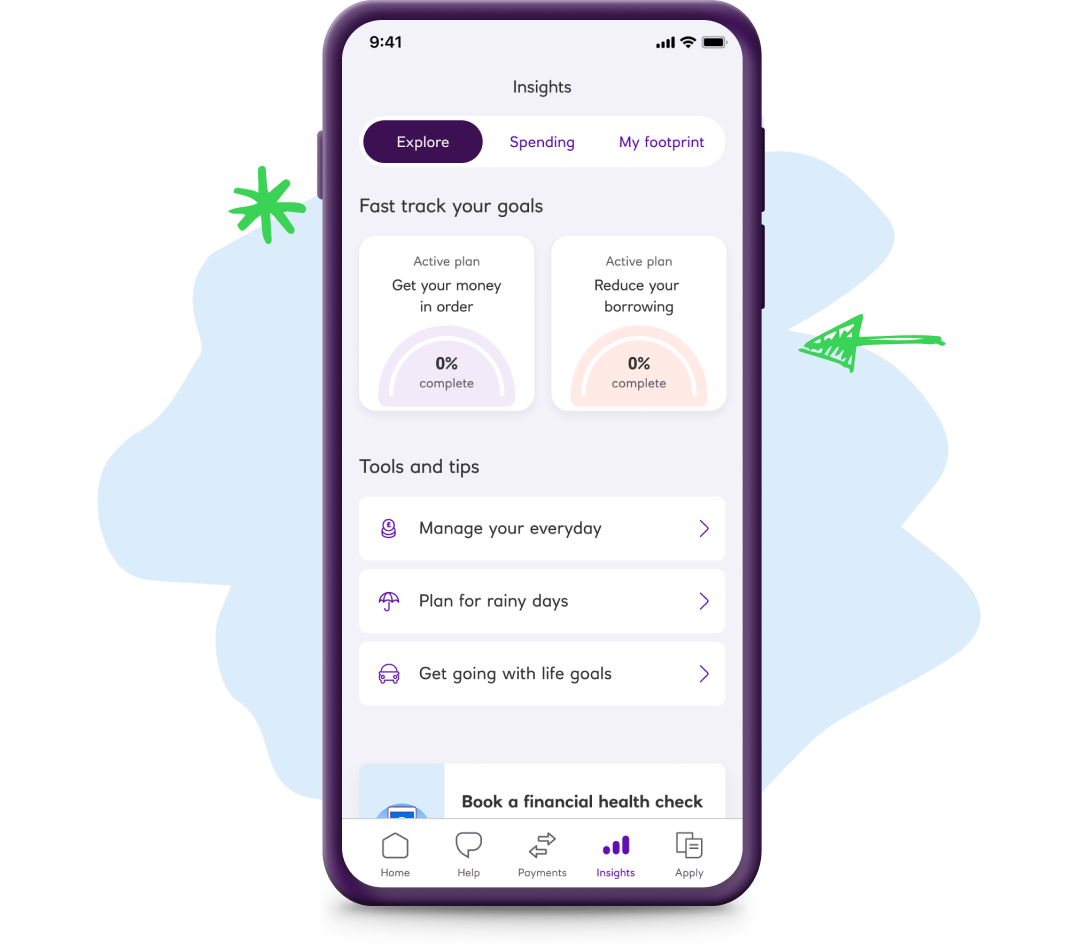

It's easy to manage your wedding loan

We make it easy to manage your loan, so you're in control:

Pay us back early, if you want

You'll just need to pay a fee.

Make overpayments

Chip away at your balance as and when you can.

Use our quick and simple app

Everything you need in one place.

Change your payment date

Just give us a call and we’ll update your Direct Debit.

It's easy to manage your wedding loan

We make it easy to manage your loan, so you're in control:

Can I pay off my loan early?

It’s important to remember that if you repay your loan early, you will be charged an Early Repayment Fee. The amount you will be charged will be equal to 58 days’ interest on the amount you repay early (28 days’ interest if the period of the Loan is one year or less). If there is less than 58 days (or 28 days if applicable) remaining on the loan, the calculation will be based on the actual number of days remaining. This is in addition to your outstanding loan amount and any outstanding interest.