The resurgence of coronavirus has weighed on activity in Q4, particularly in Europe. To be sure, the economic impact is less severe than in early 2020 – factories have remained open this time, so Purchasing Manufacturing Index readings have been more resilient than in the spring – but we now expect the global economy to contract by 0.2% in Q4. At the end of September, we’d expected it to grow by 1.5%.

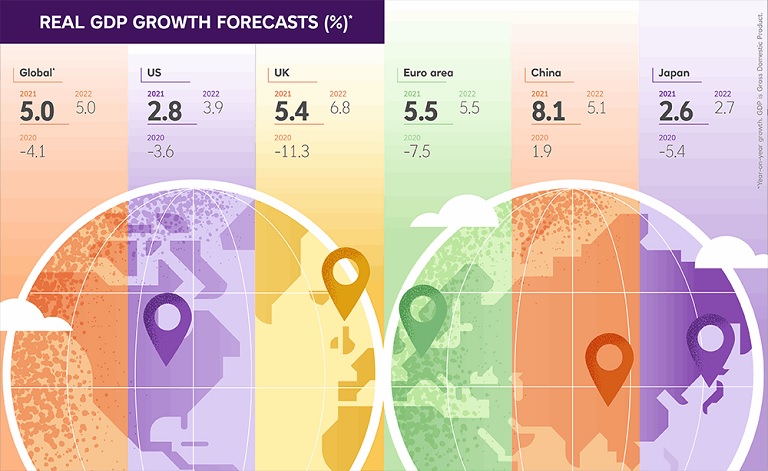

We now forecast the global economy will contract by 4.1% in 2020 overall, but we’re more confident about the outlook for 2021 and beyond, with economic momentum set to build. In fact, our forecast is for 5.0% growth both next year and in 2022. Global growth should really start to power ahead from the second half of next year as vaccines become widely available and demand begins to normalise.

As the latest downturn was largely consumer-led, household consumption rather than investment should drive the acceleration in growth. But while the economy will heal, the “scarring” resulting from business insolvencies and persistently high unemployment will linger. Indeed, we’re expecting unemployment rates in the UK, euro area and Japan to rise in 2021 and to remain above pre-crisis levels across the world well into 2022.

As the crisis subsides, we expect the countries and regions that are the economic winners and losers of the post-coronavirus world to become apparent. While global activity may reach its pre-crisis level in mid-2021, some major economies are unlikely to see a return to their pre-coronavirus trend levels until well after 2022.