With companies across the consumer sector transforming their business models to forge a sustainable future, five key themes have emerged:

- Scope 1, 2 and 3 GHG Emissions

- Sustainable Supply Chains

- Reduction in the use of plastic

- Waste mitigation and management

- Positive marketing and ESG education

Here we look at each theme.

1) Scope 1, 2 and 3 GHG Emissions: the challenge with Scope 3

While data is more readily available to measure Scope 1 and 2 emissions, and companies have greater control over initiatives to reduce these emissions – for example by sourcing renewable electricity or transitioning to clean transportation – Scope 3 emissions are much trickier to both observe and manage. Despite such challenges, pressure on companies from stakeholders is fast increasing to track all GHG emissions and establish reduction targets across each of the three Scopes in line with the Science-Based Targets Initiative (SBTi).

Scope 3 targets are continuing to create top-down pressure in the mid-corporate space for suppliers to set and report their ESG impact, with greater onus being placed on larger companies to develop their suppliers’ ESG capabilities. Institutions such as the Carbon Disclosure Project (CDP) are working with large purchasing organisations including Microsoft, Diageo, and Sainsbury’s as part of their Supply Chain programmes to encourage companies in their respective supply chains to disclose their GHG emissions. Moreover, it is becoming more commonplace to include ESG thresholds within procurement policies, with corporates like Arla implementing sustainability incentives for their farmers.

For further GHG emission examples and initiatives, please see our Carbonomics series which can be found here.

2) Sustainable Supply Chains: increased scrutiny but increased opportunity

As visibility over value chains increases, greater focus is being placed on the full ESG impact of a company’s business model which for the Consumer Industry includes multiple tiers of suppliers (i.e. suppliers of suppliers) and types of suppliers (e.g. mid-sized or small corporates, farmers etc.), making the interconnected nature of environmental and social issues ever-present.

COP27 focused on climate reparations and returned the spotlight to a Just Transition, whilst social reporting initiatives (e.g. EU’s Social Taxonomy) continue to be developed. We believe it is crucial companies ensure ethical working practices and living wages across their supply chains, redress social injustices in areas of operation (e.g. through positive marketing and education), incorporate local communities in environmental projects (e.g. nature-based solutions), and expand their sphere of existing ESG targets across their workforce, marketplace and society (Deloitte’s Equity Activation Model helps capture how businesses build a more equitable future around these three primary spheres of influence).

Industry-wide collaboration on supply chain innovation is key and seen across most Consumer Industry sub-sectors. For example, WRAP and WWF are working with eight UK Grocers to agree a common set of rules to measure and report their supply chain emissions, with the aim to collaborate and catalyse the reduction of GHG emissions from food sold; whilst AIM-PROGRESS is a forum of leading consumer goods manufacturers and suppliers, founded to share knowledge on building sustainable supply chains. Partnerships are also being created to target specific supply chain issues, such as the Sustainable Food Trust which aims to transform the food and farming systems by working closely with governments, organisations and companies to develop a globally harmonised framework for sustainability in farms.

Improved corporate transparency with ongoing regular updates is a must-have, making sure that consumers can see for themselves how their brand of choice is managing its impact. M&S, for example, offers a detailed insight into its complex supply chains through an interactive map on its website which lists, for each of its product categories, the relevant suppliers, their locations, and number of employees.

Growing alignment among ESG reporting frameworks (e.g. ISSB’s December update) and ESG rating agencies will also help strengthen supply chain transparency and the importance of detailed impact reporting. Similarly, ongoing audits and verification are crucial to ensure suppliers operate at a specified standard.

3) Reduction in the use of plastic: consumer and political campaigns push to reduce plastic consumption

Consumer companies need to demonstrate that they are proactively working to reduce the total amount of plastic used throughout their value chain. For example, despite being the main sponsor of COP27, Coca Cola continued to face criticism for being the world’s biggest plastic polluter. Regulation is also catching up, with growing attention to plastics at a national and European level: the UK government banned the sale of several single-use plastic items from takeaway businesses, food vendors, and hospitality industry in Jan-23; whilst Defra aims to increase responsibility for packaging producers, in alignment with the ‘polluter pays’ principle.

By targeting a reduction of plastic usage, companies will invertedly reduce their Scope 3 emissions and mitigate reputational risk from the growing focus on all types of waste produced by companies.

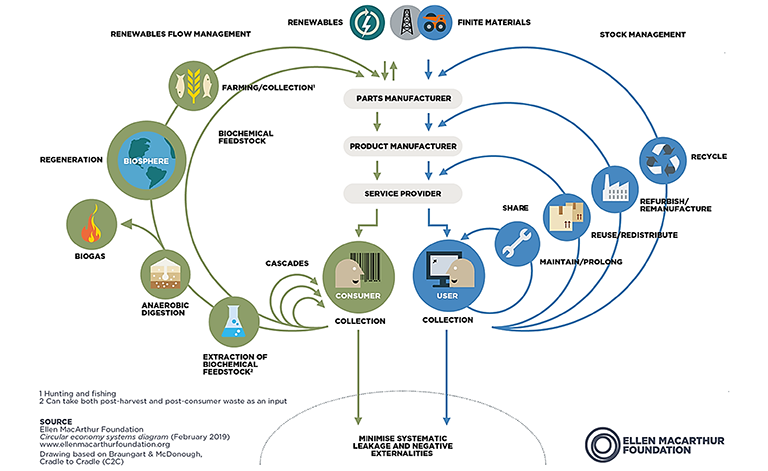

4) Circular Economy: “take-make-dispose” impossible to sustain

A circular economy is based on three principles: eliminate waste and pollution, circulate products and materials, and regenerate nature. Organisations such as the Ellen MacArthur Foundation, the Waste and Resources Action Programme (WRAP), and the Cradle to Cradle Products Innovation Institute, are driving the switch towards a circular economy, distinguishing between durable and consumable components to ensure disassembly and reuse: