*3 months before and after the announcement of an inaugural sovereign green bond

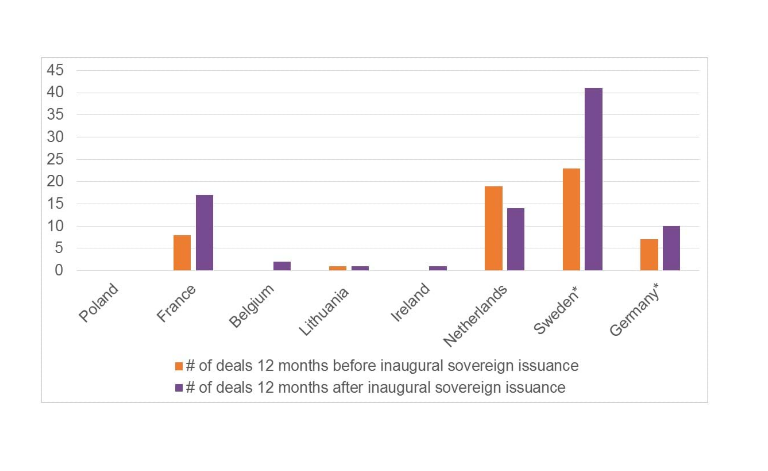

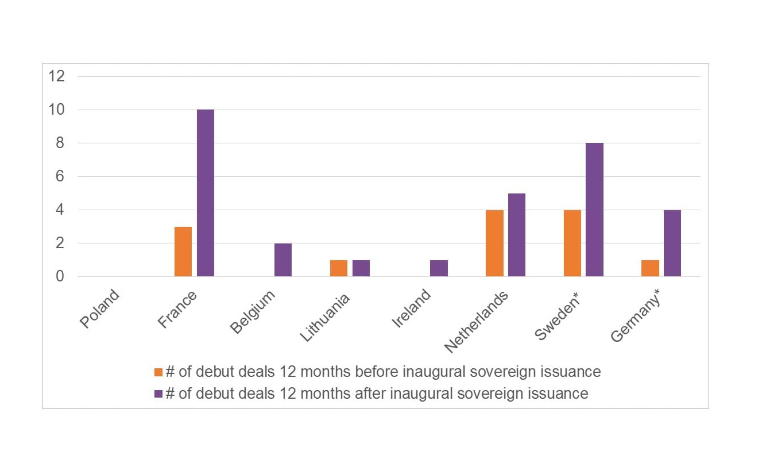

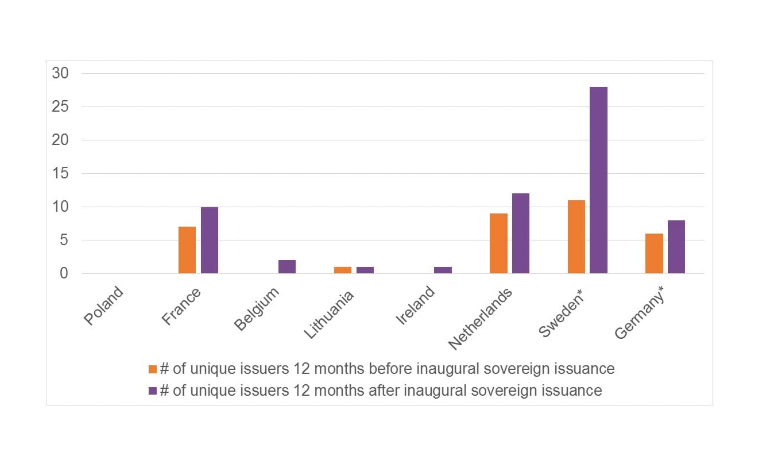

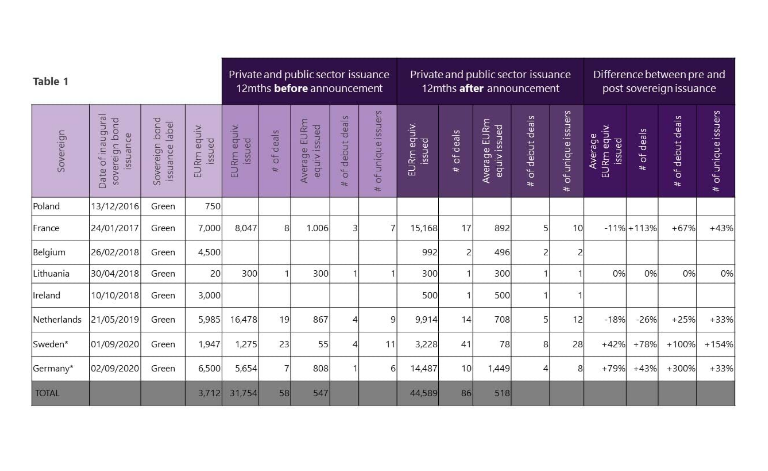

Of course, sovereign green bond issuance isn’t automatically a “magic bullet” for every country as the apparent non-effect on various economies, such as Poland, illustrates. It may also simply be the case that sustainable debt issuances take longer to emerge after a sovereign has set the scene: in Belgium, corporate sustainable bonds, such as the likes of Cofinimmo and Fluvius, needed nearly two years after sovereign issuance coming to market.

What do these examples tell us? Well – like the ancient city of Rome – green bond markets aren’t built in a day, but sovereign green bond issuance can certainly help.

Thanks to Gregory Efthimiou for helpful research assistance.