On this page

Coping with business disruption

What could you do to make your business more resilient to change? Our toolkit helps you understand resilience and how it works for you and your business.

Inspiration from NatWest

Our online resources for business

Business Builder resources could give you the confidence to take your business further. There’s tools, checklists and videos to discover.

Entrepreneur Accelerator

Made to empower businesses looking to grow, entrepreneurs could apply to our accelerator hubs, where we support you to develop your business.

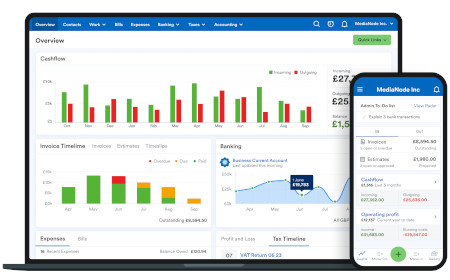

Free accounting software

FreeAgent's accounting software is used by over 150,000 small businesses to monitor cash flow, fire off invoices and record expenses.

You can get FreeAgent for free, as long as you retain your NatWest business current account. Optional add-ons may be chargeable.

Fee free banking. Charges for unarranged borrowing, Bankline, international payments and any additional services are not part of the free banking offer. At the end of your 2 year free banking period, you’ll start to incur fees for your everyday transactions. We reserve the right to change or withdraw the start up offer without prior notice.