On this page

Services only available with a NatWest account, Mettle is a free mobile account (see below for details). Mettle+ is available for an additional charge.

FreeAgent is free for as long as you retain your business bank account (optional add-ons may be chargeable). FreeAgent with Mettle requires you to make at least one transaction per month with your Mettle account.

App available to customers with compatible iOS and Android devices and a UK or international mobile number in specific countries.

Starting something new?

Extra support for your start-up, plus free banking on everyday transactions for 2 years*

- For businesses trading less than a year with turnover of less than £1m

- Free programmes that could help you grow and support that could help you run your business better (some programmes available to customers and non-customers)

- Connect with experts who could take you further and help achieve your goals sooner

*Free banking on everyday transactions means the charges for the day to day running of your account (known as your service charges) won’t apply during the free banking period. Charges for unarranged overdrafts, Bankline, international payments and any additional services are not part of the free banking offer. At the end of this period, you’ll be automatically moved to the Standard Tariff.

Established and looking to grow?

An account for big ambitions, with no minimum monthly charge - only pay for what you use

- For businesses with turnover above £1m trading under or over a year, or turnover below £1m trading for over a year

- Specialist business support to develop your business (eligibility criteria apply)

- A dedicated Relationship Manager to look after your business (turnover and eligibility criteria apply)

Self-employed or side hustle?

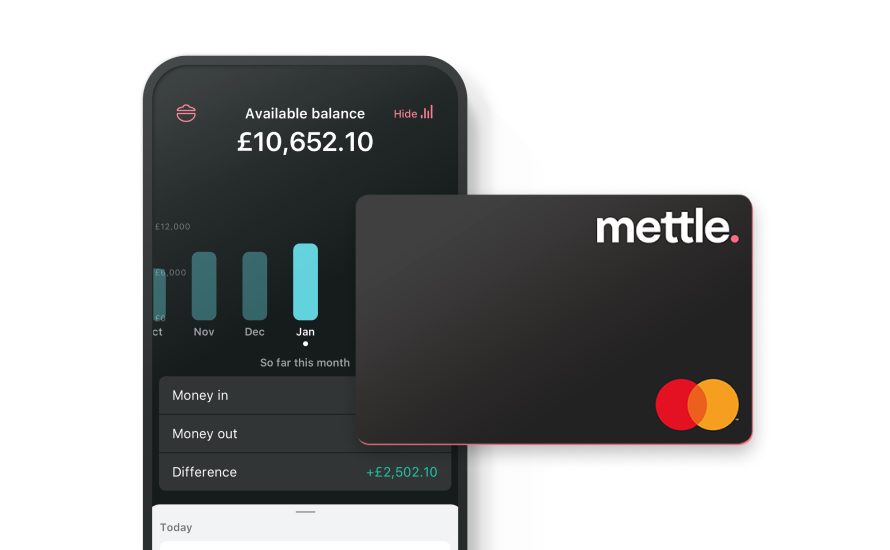

Free mobile business account

- For sole traders and limited companies with up to two owners and balances of less than £1m (UK residents only)

- Free bank account – no transaction charges

- You won’t have access to credit or borrowing options and cheques

Mettle+ is available for an additional charge and includes a quotes and invoicing feature.

Not for profit, like a charity or club?

Community account

- Existing NatWest personal or business banking customers are eligible to apply for free banking if your community account's annual credit turnover is less than £100,000 and remains at this level

- Everyday support from texts and email alerts

- Authorise up to four individual signatories

Have a business account somewhere else? Switching is simple

The Current Account Switch Service will do all the work for you, moving everything across from your old account to your new account, all within 7 working days, including Direct Debits and standing orders. Simply apply for any of our business accounts and tell us you’re switching.

Current Account Switch Guarantee (PDF, 40KB)

Your Guide to switching your account to us (PDF, 2.3MB)

How does the Switch Service work?

The Current Account Switch Service is not currently available for Mettle.

What you need to open a NatWest business account

Participating providers of UK business bank accounts have agreed to a basic set of information that they will need from you to set up your UK business current account. Find out what you’ll need to provide using the simple business banking checklist from UK Finance, the UK’s leading trade association for financial services.

See how our accounts compare

If you’d like to see how our Business Bank account products stack up against the others in the market, you can compare them at the following websites (suggested by the UK Government's Competition and Markets Authority):

Have a look at some of our service measures

If you want to see how we have performed on key service areas, you can get a detailed view here.

Planning your Great Unretirement? Three reasons to consider starting your own business

The Great Unretirement is seeing thousands of people aged 50 to 65 returning to work – and they’re returning on their own terms.