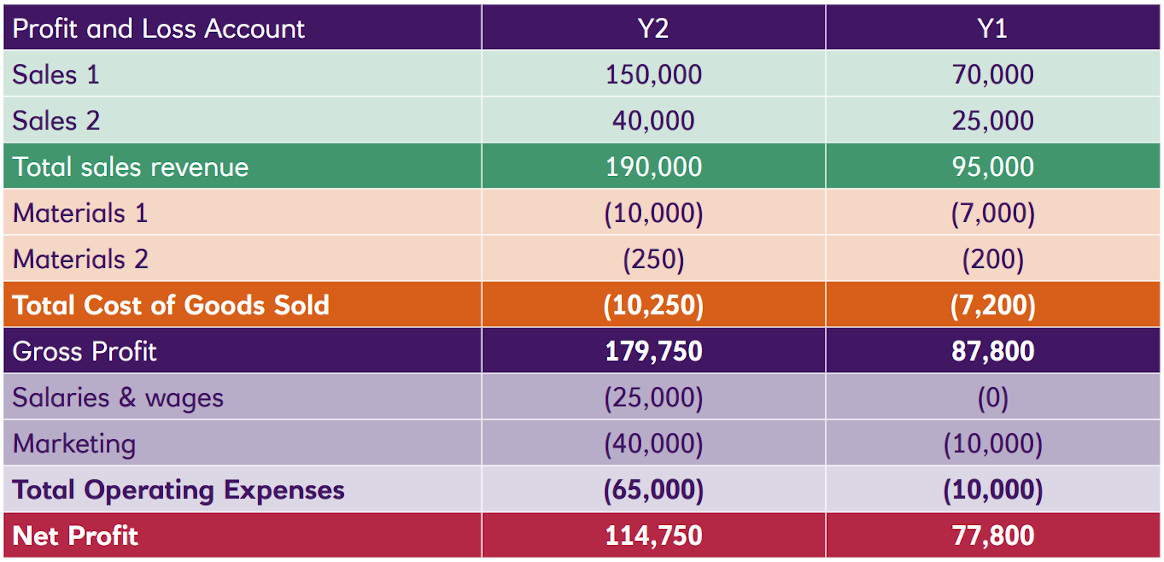

Start your statement

It’s time to bring the revenues and costs together to build a profit and loss statement for your own business.

Don’t worry if you don’t have all the figures yet, use the numbers that you do have to build the structure as it is now and fill in the gaps as you develop the business.

It’s made up of 5 elements:

You start with your revenue at the top line and then subtract any costs until you’re left with your net profit at the bottom. What’s left over is either your profit or loss depending whether you’ve spent more through your cost structure than you’ve generated in revenue.

-

1

Revenue

The total amount of revenue generated during that period of time.

-

2

Cost of goods sold

The operating costs associated with earning the revenue, manufacturing, packaging or delivery.

-

3

Gross profit

What you make after deducting the costs associated with making and selling its products or services.

-

4

Operating expenses

Cover all of the expenses you incur to keep your doors open and be fixed or variable.

-

5

Net profit

Often called the bottom line and factoring in all business-wide expenses.

Calculate your profit margins

How can you really understand if your business is profitable in the long term? Profit margins can help you to indicate the profitability of your overall business, as well as drilling down in to the profitability of revenue streams and even product lines. It’s expressed as a percentage – the higher the number, the more profitable the business.

Gross Profit Margin

Usually applies to a specific product or line, rather than the whole business. Calculating it helps you to determine pricing decisions, because a low gross profit could mean you need to charge more to make selling a specific product worthwhile.

Sales revenue - cost of goods sold = gross profit

E.g. £12,000 - £8,000 = £4,000

Gross profit ÷ sales revenue = gross profit margin

E.g. £4,000 ÷ £12,000 = 0.33

0.33 x 100 = 33%

Net Profit Margin

A calculation that expresses the profitability of an entire company, not just a product or service. It’s also expressed as a percentage. The higher the number, the more profitable the company.

Total sales revenue – total expenses = net profit

E.g. £12,000 - £10,000 = £2,000

Net profit ÷ total sales revenue = net profit margin

E.g. £2,000 ÷ £12,000 = 0.16

0.16 x 100 = 16%

Top tips for managing your finances

- Know what you don’t know – try to always challenge yourself to find out what you don’t know

- Set up good systems and stick to them

- Never take your eye off the cash flow and understand what that means in practice

- Keep an eye on the figures – do it little and often, like once a week, rather than at the end of each month

What's next?

- Some crucial tools to help you understand and manage your finances

- Strengthen your finances to stay on top of future plans

- Build your skills as a business owner with our bite-sized lessons, toolkits and courses

We (NatWest Group plc) can't accept responsibility for any decisions or actions you take based on this article. It’s for information only and not meant to offer specific advice. And although we think it’s reliable, we haven’t independently checked all the information in it. You also shouldn’t copy the article anywhere without our consent. All views and forecasts in it are ours and can change.