This rate is available on loans between £7,500 and £14,950. Other loan amounts are available at alternative rates. Our rates depend on your circumstances, loan amount and term and may differ from the Representative APR.

To apply for a loan online, you must be 18+ and a UK resident. Had a current account with us for 3+ months? You could borrow up to £50,000. Otherwise, if you don't have a current account, you could borrow up to £35,000.

What is a home improvement loan?

Want to revamp your nest? From odd jobs to grand designs, a home improvement loan could make it happen.

You could borrow up to £50,000 over 1 to 10 years dependent on how much you are borrowing. If approved, your money will wing its way straight to your account.

You could get your money today

Just sign your loan documents before 5.45pm Monday to Friday, excluding bank holidays. (It may take longer if we need more info.) You must apply online and be unconditionally accepted.

It's quick and easy to apply

It takes minutes to apply online. In fact, you could be done in the time it takes to brew a cuppa. We also make it a breeze for you, as we fill out your info where we can.

Borrow up to £50,000 (fixed rate)

Your interest rate is fixed. So, you'll pay the same amount each month (you must pay the full amount, on time, or you may have fees on top). Your last payment may might be higher or lower.

How long could I borrow for?

Home Improvement loan calculator

Representative Example

£7,500

0 months

£137.55

£8,253.00

3.9

% APR

3.9

% p.a.

The rate you pay depends on your circumstances, loan amount and term and may differ from the Representative APR. We will never offer you a rate exceeding 29.9% p.a. (fixed), regardless of loan size. This means you're not guaranteed to get the rate you see in the calculator.

Get a free personalised quote

Find out if you're likely to be approved for a loan and get your personalised rate at the start of your application. It only takes a few moments and there's no impact on your credit score.

Take a break with a 3-month loan repayment holiday

- At the start of your application, we'll give you a quote. This might include the option to take a repayment holiday.

- You could then choose to delay your first payment by three months.

- You'll need to say if you want to take a repayment holiday before you start your loan.

If you take a loan repayment holiday, your loan will take longer to pay back. You'll also have to pay back more each month - so your loan will cost more. This is because we charge interest during your loan holiday.

It's easy to manage your home improvement loan

We make it easy to manage your loan, so you're in control:

Pay us back early, if you want

You'll just need to pay a fee.

Make overpayments

Chip away at your balance as and when you can.

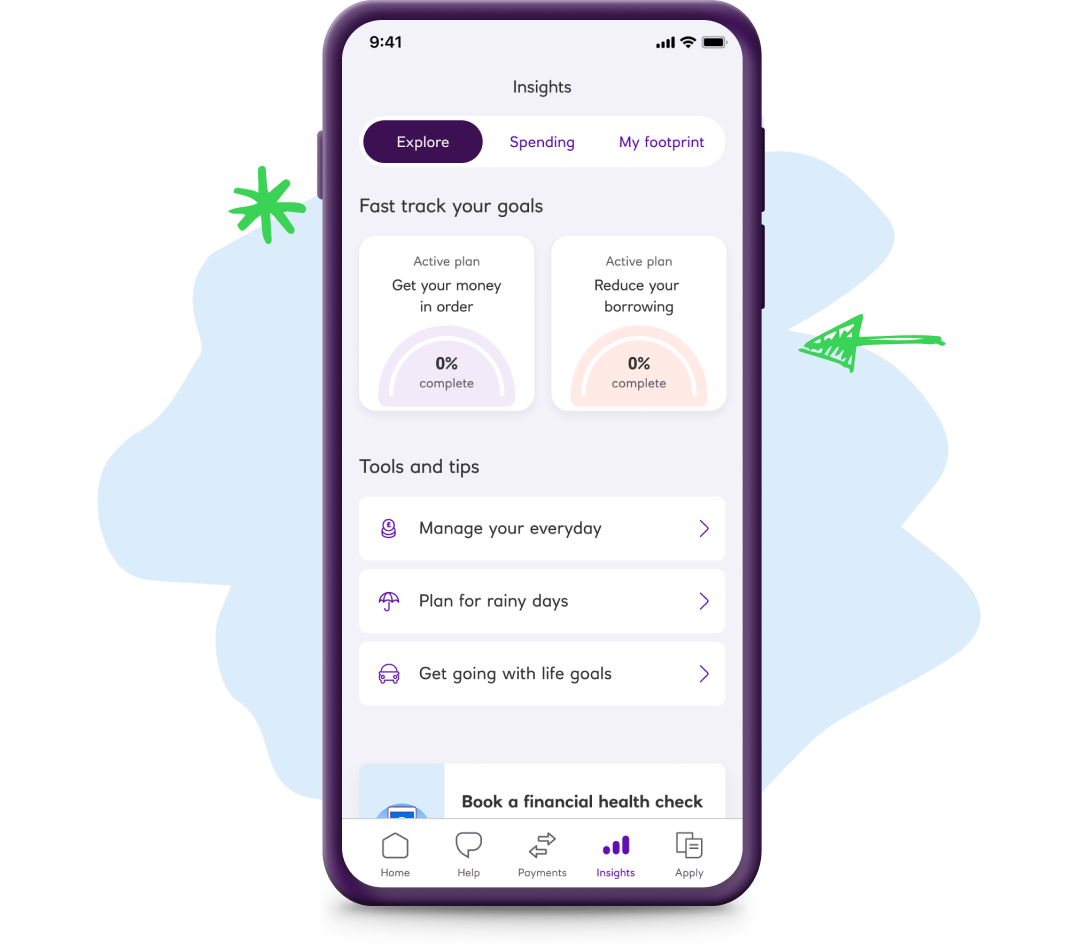

Use our quick and simple app

Everything you need in one place.

Change your payment date

Just give us a call and we’ll update your Direct Debit.

It's easy to manage your home improvement loan

We make it easy to manage your loan, so you're in control:

Can I pay off my loan early?

It’s important to remember that if you repay your loan early, you will be charged an Early Repayment Fee. The amount you will be charged will be equal to 58 days’ interest on the amount you repay early (28 days’ interest if the period of the Loan is one year or less). If there is less than 58 days (or 28 days if applicable) remaining on the loan, the calculation will be based on the actual number of days remaining. This is in addition to your outstanding loan amount and any outstanding interest.