On this page

Making sense of your salary

Before you can start to think about budgeting, it's important to know how much you've got coming in each month and understand any deductions from your wage packet before it lands in your current account. See how can help you make sense of your salary.

Gross salary vs your net pay

Chances are you’ll already know what your gross salary is, the total amount you’re paid for the work you do each year. Your take home pay, otherwise known as net pay, is the amount you receive each month after any deductions which have to be made, like Income Tax and National Insurance.

How much tax and insurance will I pay?

You’ll find calculators and tools online to help you work this out. Gov.co.uk has tools to use whether you pay tax and insurance through your employer or you're self employed.

Changes to your working life

The coronavirus outbreak has meant changes to working life for many of us. If you've been affected by changes at work, we've put together some information you might find useful.

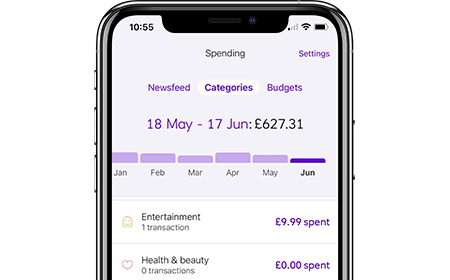

We sort your spend, so you don't have to

The NatWest app now comes with Spending. A handy feature that could help you budget better by giving you a more detailed picture of where your money goes each month.

Our App can be used on compatible iOS and Android devices. You'll need a UK or international mobile number in specific countries. Spending Tracker is available to customers aged 16+ who have a Personal or Premier account with us.

Download the app

- On your mobile or tablet, go to the App Store if using Apple or Google Play if using Android

- Search for 'NatWest Mobile Banking'

- Tap to download the app

What else could be deducted from my pay?

Pension contributions

This is where a percentage of your pay goes straight into a pension scheme each month. Your employer might contribute too and you might get tax relief from the government.

Student Loan payments

If you've taken out a Student Loan, you'll start to pay it back automatically through your monthly salary once you start earning a certain amount.

Salary sacrifice schemes

Lots of employers offer salary sacrifice schemes, where part of your pay packet automatically goes towards childcare vouchers or other benefits like the bike to work scheme.

Ready to look at your budget?

Now you know how much you've got coming in each month, see how budgeting could help you manage your money and find ways to save on your household bills and other monthly outgoings.