If you're new to NatWest, you can select a mortgage rate online and hold it for 14 days

Take control of your remortgage and lock in your rate

Select your own rate today and have peace of mind that we'll hold it for you for 14 days, whilst you consider your options. If our mortgage rates change, you've still got your rate saved.

Step 1: Get an Agreement in Principle

It takes about 10 minutes and there is no impact to your credit score.

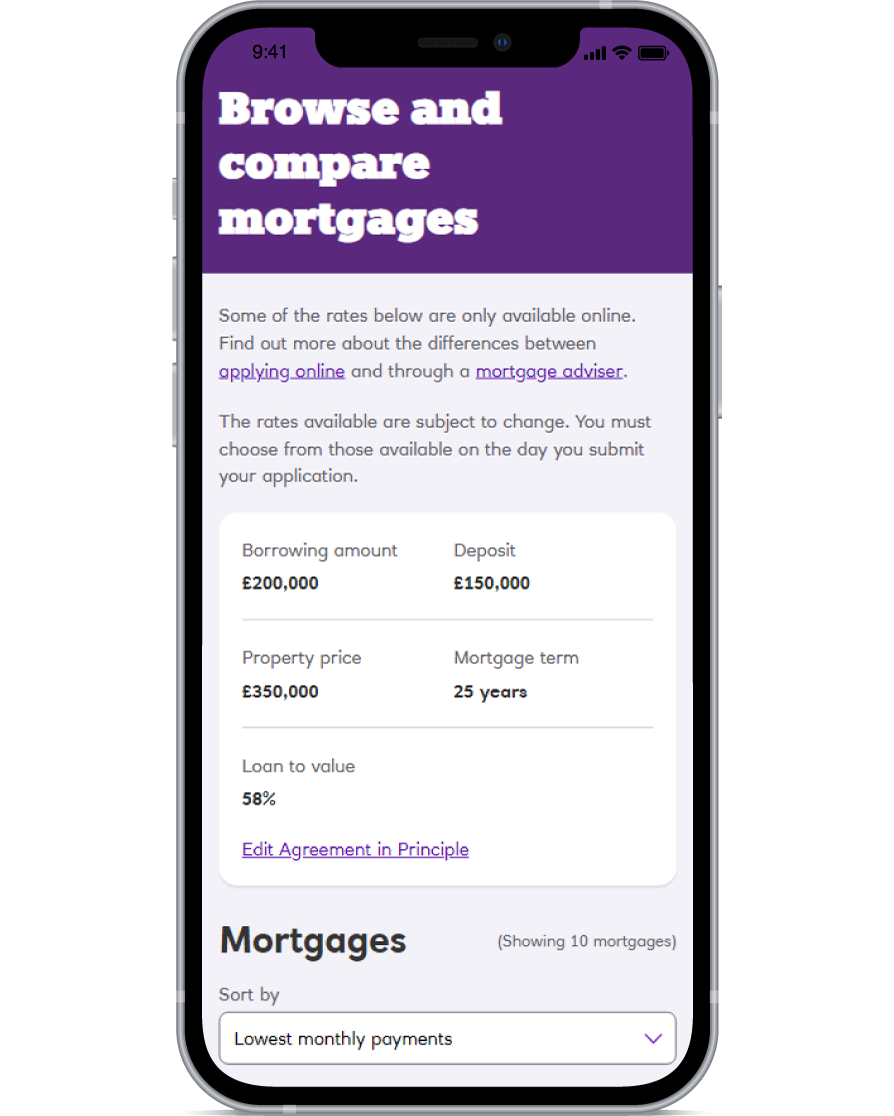

Step 2: Compare our mortgage rates

See the rates available, any fees and the monthly repayments.

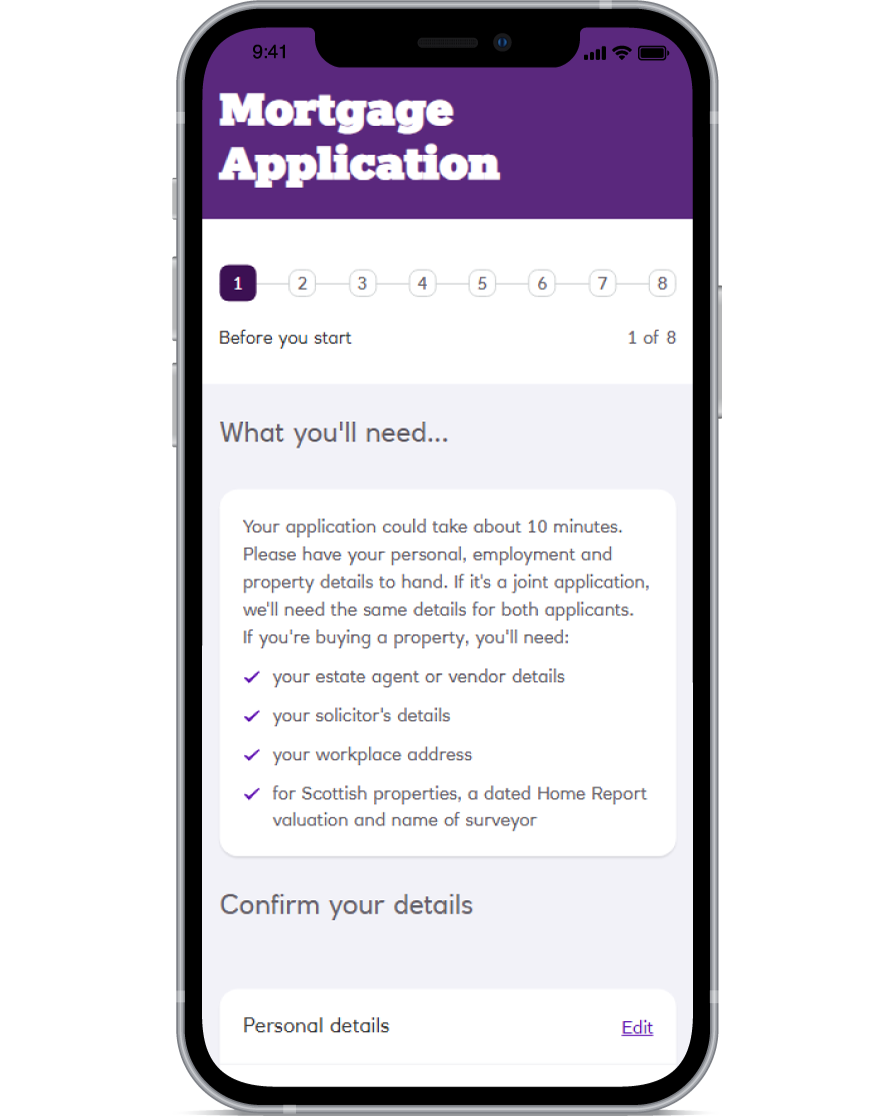

Step 3: Complete your application and lock in your rate

We'll hold your rate until you submit your supporting documents.

Take control of your remortgage and lock in your rate

Select your own rate today and have peace of mind that we'll hold it for you for 14 days, whilst you consider your options. If our mortgage rates change, you've still got your rate saved.

We provide you with the information to enable you to make an informed decision about a mortgage product that is right for you. If you don't feel confident applying for a mortgage by yourself, you can arrange an appointment with one of our mortgage advisers, who could advise you on a product suitable for your needs. By making your own choice you do not benefit from the protection of us making a recommendation suitable for your needs and you alone are responsible for the choice that you make. This means that you would not be eligible for compensation if the product you choose turns out to be inappropriate for your needs.

What does a remortgage mean?

A remortgage is when you change the mortgage you currently have on your property by moving it to a new lender.

Get an Agreement in Principle

An Agreement in Principle gives you a personalised indication of how much you could borrow. It takes less than 10 minutes and doesn't impact your credit score.

Remortgage from another lender

See our current rates, the monthly payments and find out about any fees involved. Simply choose the 'remortgage from another lender' option as you move through our tool, to see an indication of the remortgage rate we may be able to offer you.

How does remortgaging work?

There's a few steps to take, depending on your circumstances. If you are unsure how remortgaging works then take a look at our step by step guide for more information on the process. We'll outline everything you need to do and consider when you remortgage with us.

How to remortgage with NatWest

Choose how you want to apply

Apply online

If you are confident in choosing the right mortgage without any advice from us, you can apply online.

You need to be aware that you will be responsible for the mortgage that you choose.

Already Started? Pick up where you left off

Apply over the phone

Need advice to select the right mortgage product for your circumstances?

Make an appointment to speak to one of our mortgage professionals, on a phone or video call.

Call us now on 0800 096 9527

Opening hours: Mon-Fri 8am-6pm, Sat 9am-4pm, Sun Closed. Excluding public holidays.

We provide you with the information to enable you to make an informed decision about a mortgage product that is right for you. If you don't feel confident applying for a mortgage by yourself, you can arrange an appointment with one of our mortgage advisers, who could advise you on a product suitable for your needs. By making your own choice you do not benefit from the protection of us making a recommendation suitable for your needs and you alone are responsible for the choice that you make. This means that you would not be eligible for compensation if the product you choose turns out to be inappropriate for your needs.

Green Mortgages

For customers with energy efficient homes, we're offering discounted 2 year or 5 year fixed rate mortgages when you move your mortgage to us.

If you have a home with a valid Energy Performance Certificate (EPC) rating of A or B, you could be eligible. Product fees may apply.

The offer is only available on selected mortgages marked with ‘Green Remortgage’ and can be changed or withdrawn at any point. Max LTV 85%. Find out more about green mortgages.

Early repayment charges may apply.

Need some help?

Call us

We're on hand to arrange a phone or video call with one of our qualified mortgage professionals. We can also help with any general queries about the process.

Call us on ${dn-0800 096 9527}

Opening hours: Mon-Fri 8am-6pm, Sat 9am-4pm, Sun Closed. Excluding public holidays.

Buy to Let? We only provide Buy to Let mortgages online for small portfolio landlords.

- Please use our tools and guidance designed to help you complete your mortgage application online.

- We do not provide advice on Buy to Let mortgages but if you need technical help with your online application, get in touch so we can provide support.

- If you are not a small portfolio landlord, or you wish to apply with a mortgage professional, NatWest Buy to Let mortgages are available via mortgage brokers.