£150 Switch offer now available with our Reward bank accounts. Offer T&Cs and restrictions apply.

£150 Switch offer with our Reward accounts

Apply online or via our app to switch your current account held elsewhere in to an eligible Reward account using the Current Account Switch Service and you could get £150.

Switch to us

Don't have a current account with us?

Simply open a Reward account and switch to us.

Already have a current account with us?

Switch a current account held elsewhere in to your existing account with us and change that account to one of our Reward accounts.

If you already have an eligible Reward account, you only need to complete the switch.

Within 60 days of switching

Check you have the right account

Make sure you have an eligible Reward account.

Pay in £1,250

This can be made of multiple payments and must remain in the account for 24 hours.

Log in to our mobile app

This can be done on any device that supports the NatWest mobile banking app.

You're all set

When you've met these conditions, we'll pay £150 into your eligible account within 30 days.

Reward bank account

Cha-ching! Get money back on your everyday spend with over 20 retailers for only £2 a month.

Eligible for our £150 Switch offer.

Earn £4 a month in Rewards for 2 or more Direct Debits of at least £2.

Earn £1 a month in Rewards just by logging into our mobile app.

Earn from 1% back in Rewards when you spend at our partner retailers.

Earn Rewards as cash back into your bank account or e-gift codes with our retail partners.

Must be 18+, UK resident, and pay in £1,250 to an eligible NatWest account every month. T&Cs apply.

Everyday bank account

The basic everyday bank account that helps you take action, also known as our Select account.

Not eligible for our £150 switch offer.

- No hassle: it's easy to set up and use this basic bank account. And there's zero monthly fee.

- Save the change: watch the pennies add up (and up and up) with Round Ups and a linked instant access savings account. Criteria apply.

- Check how you're doing: monitor your progress with spend tracking and budgeting.

- Your day-to-day made easy: with Split the Bill, 24/7 support, and cardless cash withdrawals. Criteria and limits apply to these bank account features.

Must be 18+ and UK resident to apply.

Children's and teen accounts

Looking for a kid's bank account?

Adapt account (11-17 year olds)

- Current account with a contactless debit card for 11-17 year olds.

- Earn 2.35% AER / 2.33% Gross p.a. (variable) interest on your balance.

- Apple Pay (if you're 13+) and Google Pay™ (if you're 13+). Limits apply.

Rooster Money (3-17 year olds)

- Parent-managed pocket money app for 3-17 year olds.

- Set allowances and track your kids' spending and saving.

Eligibility criteria, fees & charges may apply. T&Cs apply (PDF, 100KB).

Student bank account

A current account to make student life easier

4-year tastecard with our Student bank accounts. Offer T&Cs apply.

18 or older? Interest-free overdraft - get an overdraft of up to £2,000 from year one (limited to £500 in term one year one), with an instant online decision. Students can apply for up to £3,250 interest-free from year three onwards.

Fee free.

Specific account eligibility criteria apply. Overdraft subject to eligibility.

Premier accounts

Starting from £0 a month

Premier Reward accounts eligible for our £150 Switch offer.

Open a bank account and get access to dedicated support, financial planning and a range of benefits that could make your life easier.

Specific account and Premier eligibility criteria apply. Fees may apply to specific products and services.

Joint accounts

Share your banking

A joint bank account could make sense if you're looking to share your Select or Reward account with someone you trust.

Foundation account

A straightforward current account

Not eligible for our £150 Switch offer.

If you're not eligible for the bank account you are applying for, you might be offered the Foundation account instead. You can't apply directly for this current account.

Ukrainian refugee account

Let's get you set up with a UK bank account

We've set up a new account opening process for you. Choose from the languages below to find more details and eligibility criteria.

Reward Silver

£10 monthly fee

- European travel insurance.

- Mobile phone insurance.

- Fee-free foreign card purchases.

- Plus, all the benefits of the Reward current account.

Reward Platinum

£22 monthly fee

- Worldwide travel insurance.

- UK car breakdown cover.

- Includes all Reward Silver current account benefits too.

Business bank accounts

Whether you’re just starting out in business, or have been running a company for longer, we could have an account to help you go further and do more.

There’s support from business experts, specialist programmes to help you grow, and expertise to tap into so you can succeed.

Business bank accounts are available to eligible customers who are over 18. Specific account and service eligibility criteria apply.

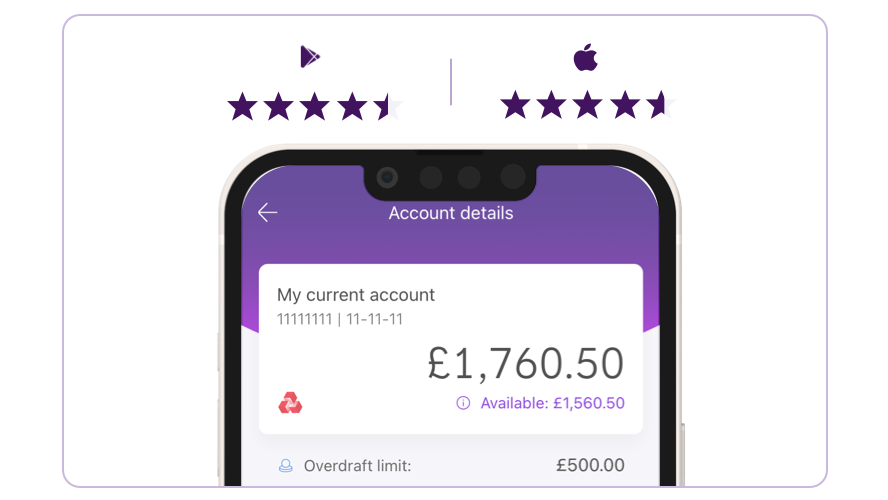

Bank whenever, wherever with our mobile app

Easy, secure, quick banking with our highly rated app.

Secure login using your fingerprint or facial recognition on selected devices.

Freeze and unfreeze your card whenever you need.

Turn on Round Ups to save money effortlessly from your current account.

Use Split the Bill to get your mates to pay you back for that lunch.

Our app is available to personal and business banking customers aged 11+ using iOS and Android devices. You'll need a UK or international mobile number in specific countries.

App Store and Google Play Store™ ratings correct as of 6th of February 2023.

Switch to NatWest

With another bank? Switching bank accounts is easy. The Current Account Switch Service will move everything from your old account over to us in 7 working days.

Let us know in your application if you want to switch bank accounts and when to get the ball rolling. Click the links below to find out more.

Protecting your money

Eligible deposits with us are protected up to a total of £85,000 by the Financial Services Compensation Scheme (FSCS), the UK's deposit guarantee scheme.

Supporting our customers

See how we've performed in key service areas and view details on how we support all personal banking customers.