Everything you need in one place for life after graduation

Interest-free graduate overdraft

An arranged overdraft allows you to go overdrawn up to an agreed limit. So, if payday is still a long way off and you’re short of cash, an arranged overdraft could help to cover an unplanned expense. Think of it as a short-term safety net.

Overdrafts are a way of borrowing money and you're responsible for repayments if you decide to use one. If you're unable to repay what is owed, you could impact your credit score, which most lenders use to decide whether they'll lend to you.

Interest-free limits

- Interest-free overdraft of up to £3,250 (for your first year after graduation).

- Year 2: £2,250 interest-free limit.

- Year 3: £1,250 interest-free limit

- Get handy text alerts to help you stay on top.

Applying is really quick

- Applying through Online Banking takes around 5 minutes.

- Get an instant decision if you bank online with us.

Access your funds, fast, once approved

- If your overdraft is approved, it’ll normally be available the next working day. But there might be a few exceptions to be aware of.

What are the overdraft costs?

Graduate arranged overdrafts are only available to eligible UK residents who have a NatWest Graduate bank account. Subject to lending criteria. Over 18s only.

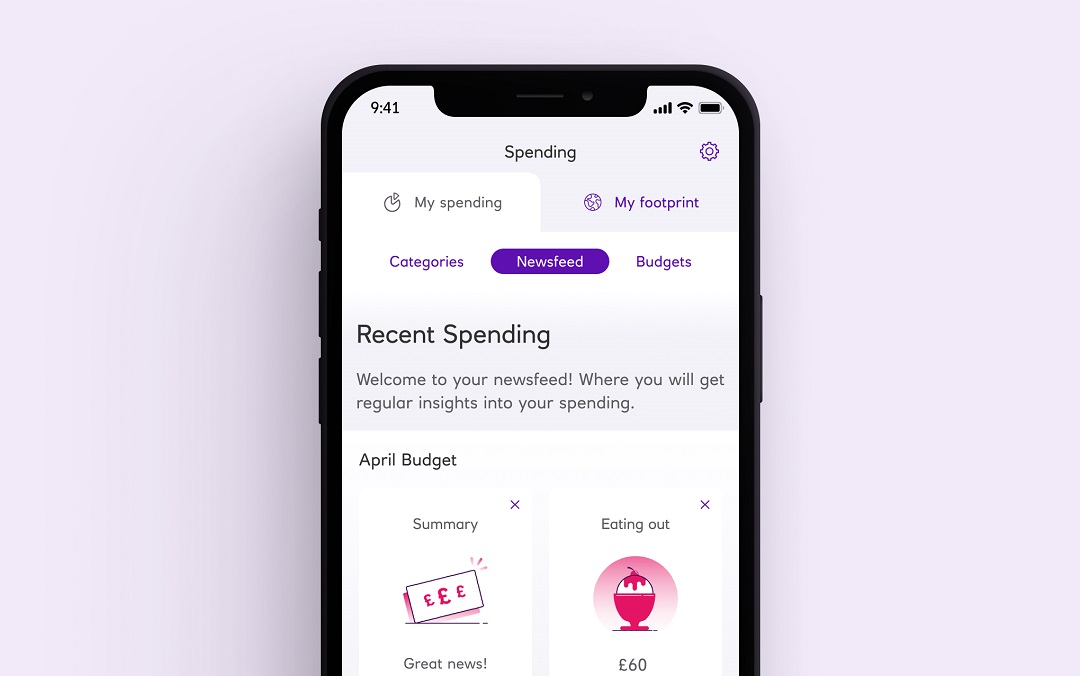

Keep track of spending

Ever got to the end of a month and wondered where your money went? Well wonder no more. Our expense tracker feature ‘Spending’ within the app tells you everything you need to know, from categorising your spend to surfacing personalised insights. You can even set budgets to help you track your spending. You can also get spending notifications every time you use your card.

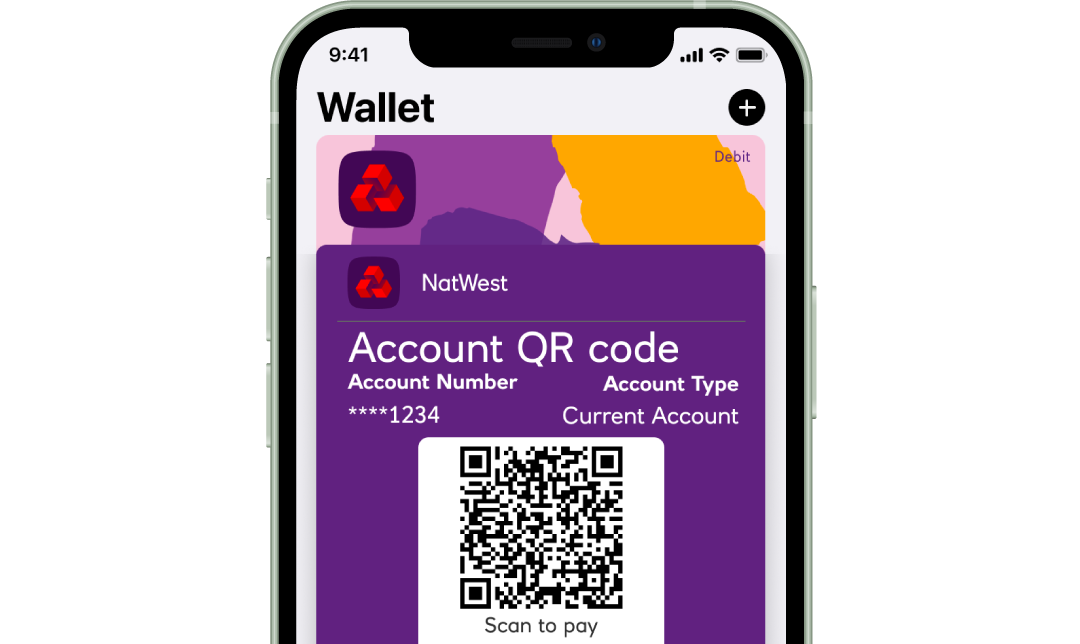

Split bills easily

Pay friends back without the faff of sharing bank details. Split Bill is an easy way to share the cost of meals, even when your mates leave their wallet at home.

- Show your QR code to get paid right away, even if your friends don't have a NatWest account.

- Add your QR code to your Apple or Google Wallet for easy access and to make getting paid back even simpler.

- Or send a payment link via your device sharing options.

Eligibility criteria and limits apply.

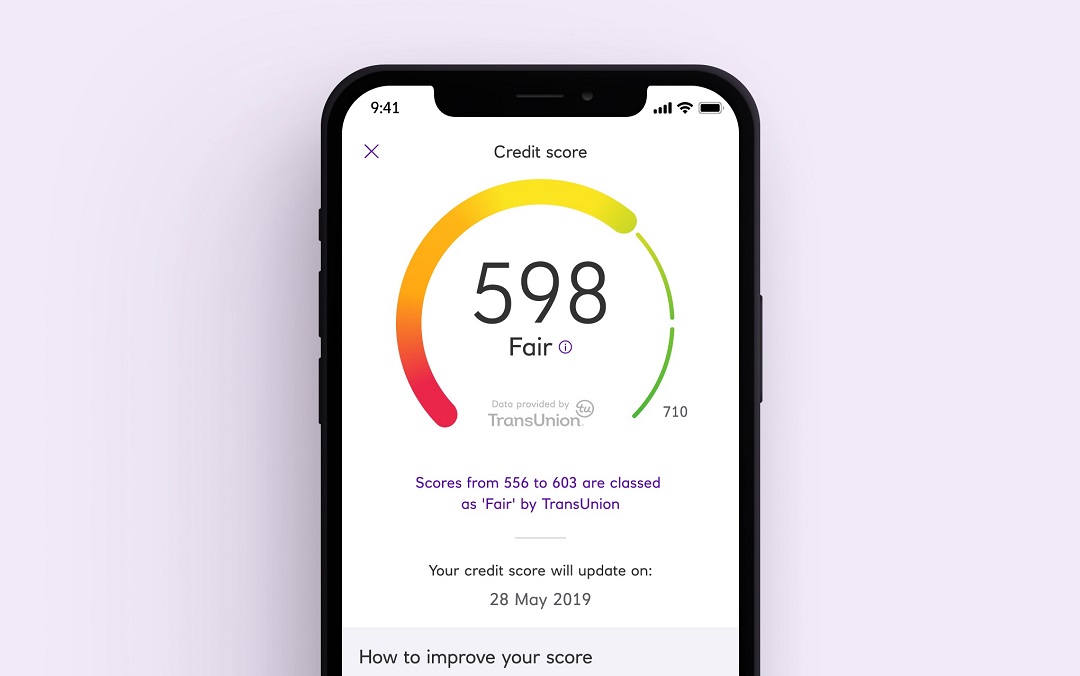

Check your credit score for free

Our personalised tips could help you improve your credit score and kick-start a brighter financial future. The higher your score, the more likely you are to get better deals and interest rates.

Credit score available once opted in through the app, to customers aged 18+, with a UK address and data is provided by TransUnion.

Renters Insurance

Insuring your belongings is a wise move, especially during your student years. Take a look at Renters insurance to see if it suits your needs.

Saving for a home

It's never too early to start planning for your future home. If you're dreaming of your own place, we could help you start your journey.

Ready to start saving?

Life is full of big moments, and putting money aside regularly could help you be ready. But there’s no one-size-fits-all, you might:

- Need fast access to your cash

- Be looking for better interest rates on your nest egg

- Have spare cash and looking to save for a longer term.

Whatever the goal we could have a NatWest Savings Account for you. Specific account eligibility critieria apply.

Find the right account for you

If you'd prefer one of our other accounts, you can change your current account online. It's quick and easy to change.

- View our current account range. Specific account eligibility criteria apply. Monthly fees may apply.

- After choosing your preferred account option, follow the steps to apply for that account.

- When applying, make sure to choose the ‘change my existing account’ option and complete the application form.

Book a financial health check

Whether you're on top of your finances or feel like you've been burying your head in the sand, we're here to help.

Our free Financial Health Check is a review of your personal finances, giving helpful hints, tips and ideas to help you get financially fitter both now and in the future.

You can complete an online review in under 5 minutes. If you’d rather speak to someone, you can book a video appointment or arrange to speak to someone over the phone or in a branch. These appointments usually last around one hour.

Want to find out more about savings?

The 2024 NatWest Savings Index shows trends in savings knowledge, attitudes and habits across the UK.

Learn how to start your savings journey and create good habits today.

Common questions about our Graduate account

Important documents to read

We do our best to ensure everyone is aware of their account terms and conditions, please take some time to review, print and/or save a copy of these.