What is a mortgage?

If you want to buy a property, you might need to borrow money from a bank. This is what we call a mortgage.

To get a mortgage you usually have to provide a bit of money first. This is called a deposit, and covers a small amount of the overall cost of the house you end up buying.

You often need a minimum deposit of 5% of the sale price, referred to as a 95% LTV (Loan to value).

Minimum deposit can vary across mortgage products and lenders so it's always worth doing your research.

How much should I save for a house?

How much you'll need really depends on the type of property you're after and where you want to live.

For example, if you're looking at a home priced around £154,000, you'd need at least a 5% deposit - that's about £7,700. This would allow you to apply for a 95% Loan-to-Value (LTV) mortgage. Saving a bigger deposit can give you more mortgage options and potentially better mortgage rates.

Don't forget to factor in other home-buying costs like legal fees, surveys and moving expenses when planning your savings.

How long should I save?

How long to save depends on how much you can afford to set aside each month.

Using the previous example, if you needed to save £7,700 and can save £150 a month that would take around 4 years.

If you can, the important thing is taking that first step and getting into a regular habit of saving. Setting a deposit goal is a great way to track your progress and help saving feel achievable.

Digital Regular Saver

Able to save £150 a month?

Check out a Digital Regular Saver account.

Save money for a house and benefit from a competitive rate up to £5,000.

To apply you must be 16+, a UK resident and hold a NatWest current account.

Help to Buy: ISA

Able to save £200 a month?

If you already have a Help to Buy: ISA you are allowed to save as much as £200 per month until November 2029. Also you could enjoy a 25% government bonus for buying your new house.

Our Help to Buy: ISA is no longer available to new customers.

Eligibility criteria and conditions apply.

Fixed Term Savings Account

Have you got a lump sum saved?

Come into unexpected funds or made strides in saving?

If you're at least a year away from buying your first home, you could consider a Fixed Term Savings account with a locked-in interest rate.

To apply you must be 16+ and a UK resident. Early closure charges may apply.

Maximise your savings using an ISA

With an Individual savings Account (ISA), watching your savings grow without tax could get you to your house deposit goal faster.

Whether its instant access or fixed term we might have the account for you.

You must be 18 or over and a UK resident for tax purposes.

You can only subscribe to one cash ISA with NatWest Bank in any tax year up to £20,000.

Investment Accounts

If saving for a new house is in your future you might want to consider a NatWest investment account as an option.

Save from £50 in either a General Investment account or a Stocks and Shares ISA.

Eligibility criteria, fees and charges apply.

The value of investments can fall as well as rise, and you may not get back the full amount you invest.

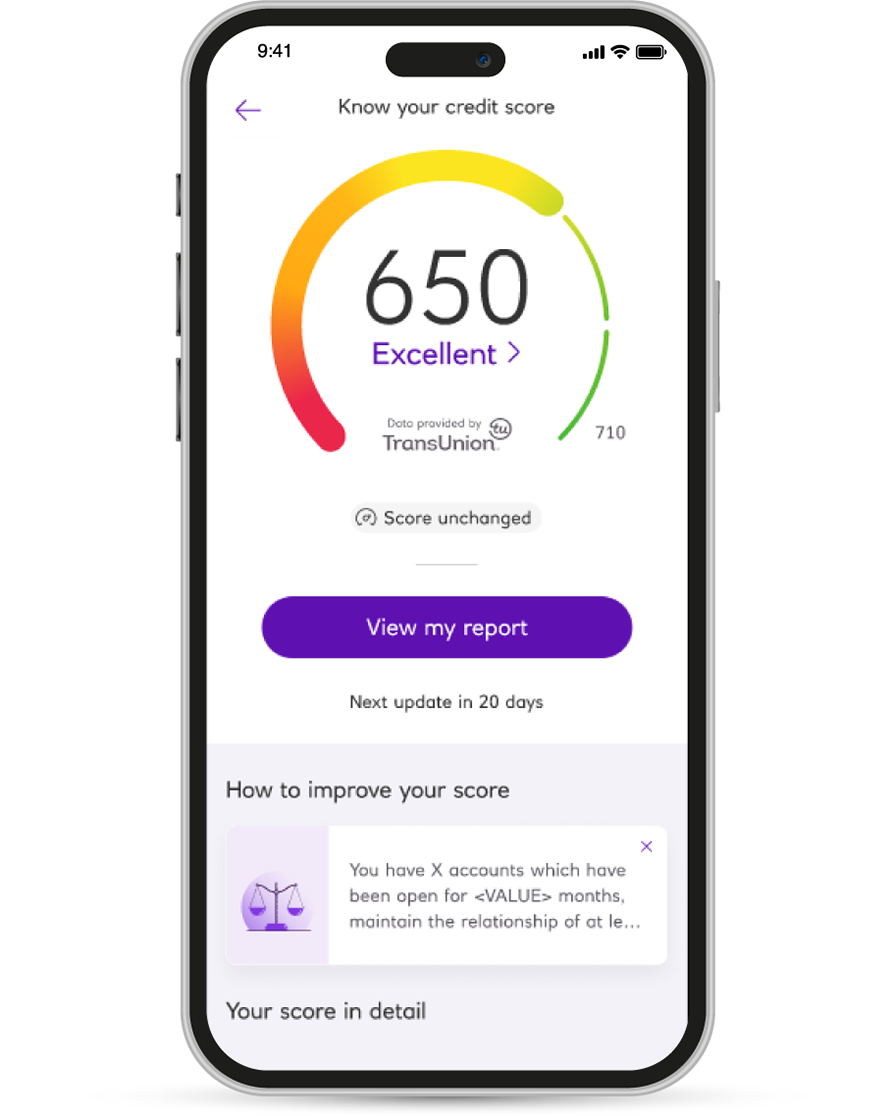

Know your Credit Score

Lenders also look at other factors including your credit history. A good score will put you in a better position to borrow. Even if you're not a NatWest customer, you can access your credit score here.

Data Provided by TransUnion.

Free Financial Health Check

Our complimentary service reviews your personal finances, offering helpful tips and ideas to help you stay financially healthy now and in the future.

Renters Insurance

Insuring your belongings can be a wise move, especially when renting. Take a look at Renters Insurance to see if it suits your needs.

Help at your fingertips

How the NatWest app can keep your deposit savings on track.

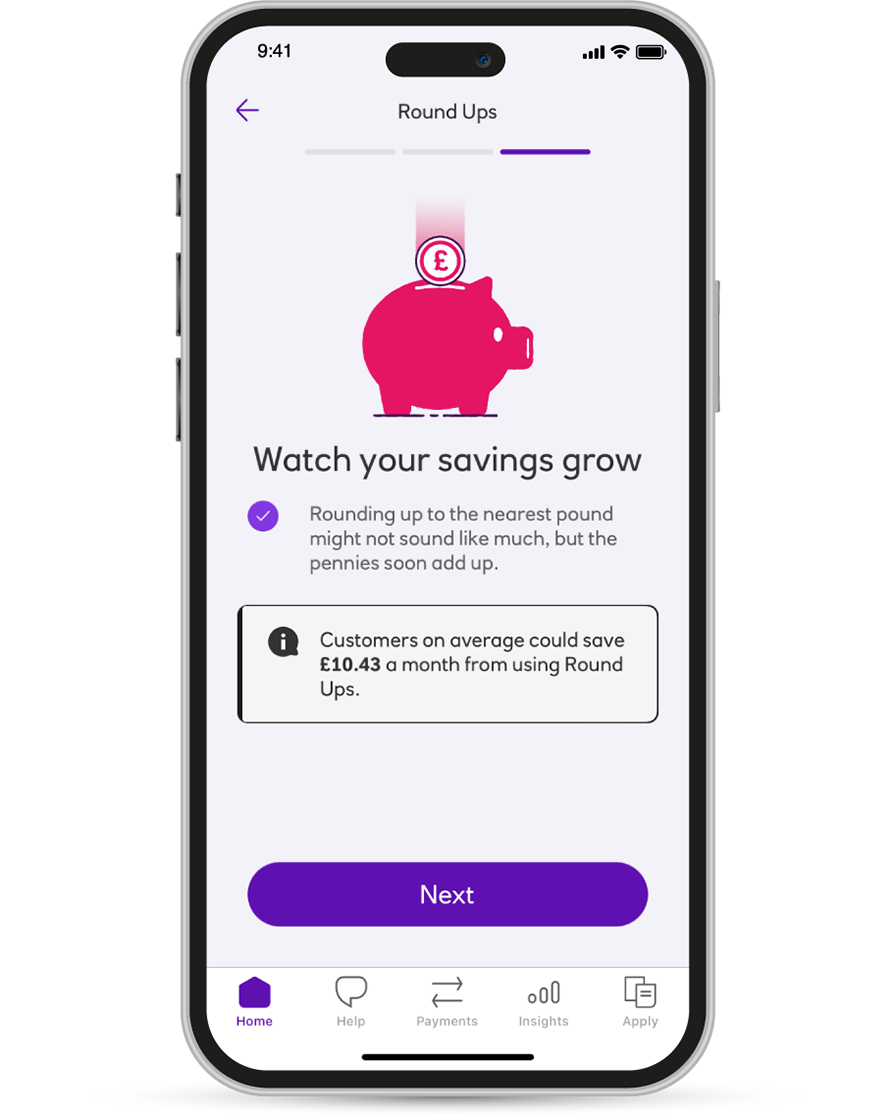

App is available to personal and business banking customers aged 11+ using compatible iOS and Android devices. You'll need a UK or international mobile number in specific countries. Eligibility criteria and conditions apply for Round Ups.

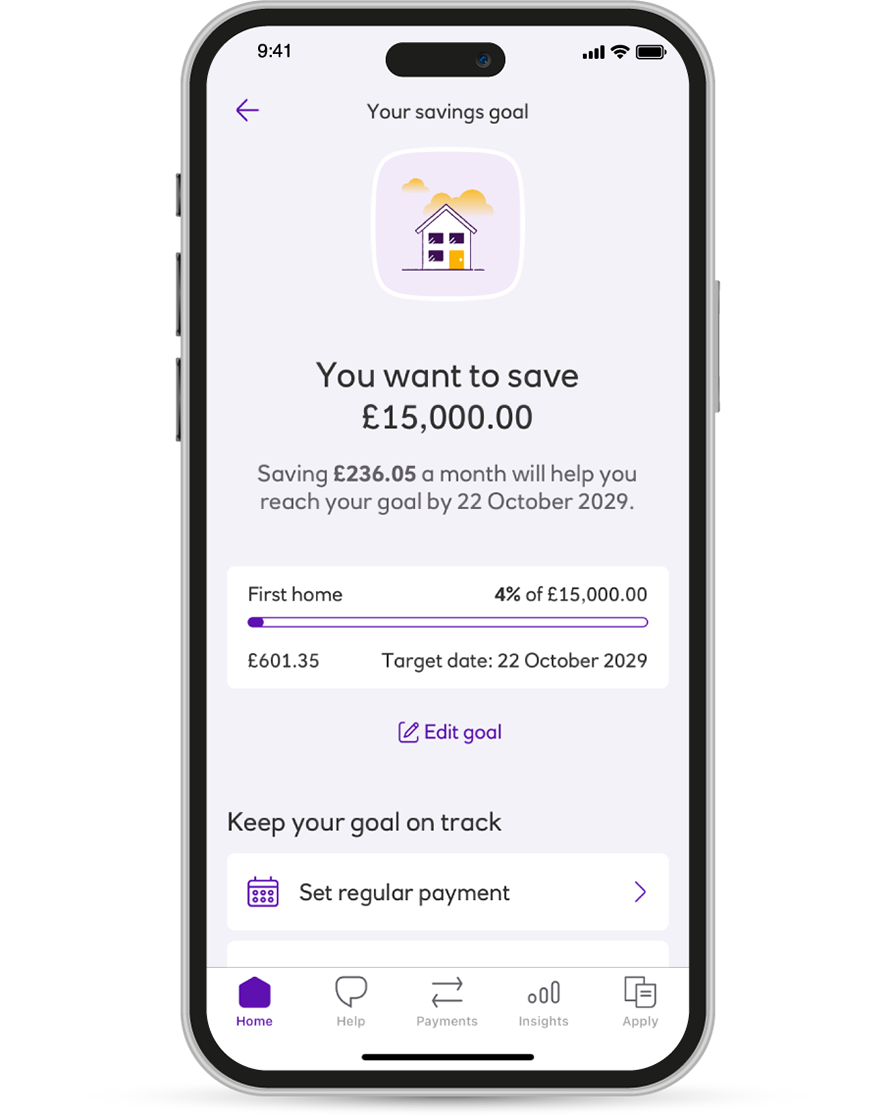

Set up a savings goal

Just tap in how much you need to save and by when.

Save effortlessly with Round Ups

Let your spare change add up towards your deposit.

Check your credit score

View your credit score and report for free.

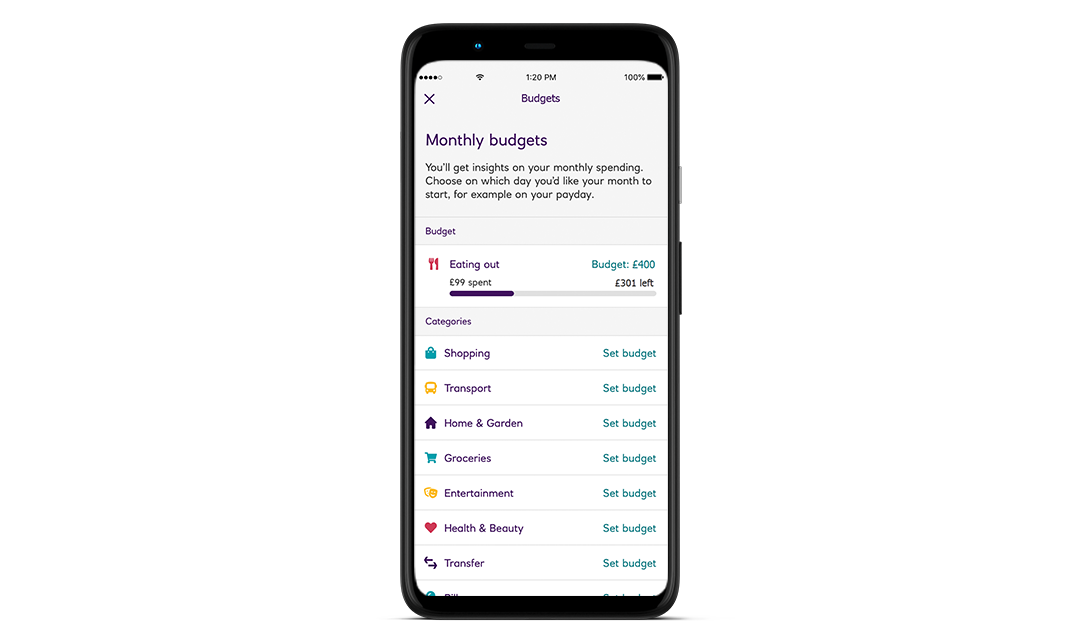

Track your spending

Take control of your spending with the spending tracker.

Set your budget

Keep your spending on track by setting yourself a budget and sticking to it.

Help at your fingertips

How the NatWest app can keep your deposit savings on track.

App is available to personal and business banking customers aged 11+ using compatible iOS and Android devices. You'll need a UK or international mobile number in specific countries. Eligibility criteria and conditions apply for Round Ups.

How mortgages work

Read our beginner guide to demystify mortgages, and understand the jargon.

Calculate how much you could borrow

Just starting out? Find out what we may be able to lend you and what your monthly repayments could be.

Get Agreement in Principle

When you’re ready to buy, get a personalised Agreement in Principle.

Costs for buying a house

It's important to know buying a house can incur further costs, such as those for solicitors and relocation.

Saving for a deposit - FAQs

Government first time buyers schemes

There are some government backed first time buyer schemes to help you get on the property ladder.

There are eligibility criteria attached to these so it’s worth doing your homework to see if you qualify.

Savings Goal Tool

Setting up a savings goal could keep you more motivated to save to buy a home.

Tap in how much you need to save and by when to track progress towards your goal.

Specific account eligibility may apply.

Compare your bank account options

See if your current account is the best fit.

Are you missing out on earning Rewards back on your everyday banking that could be exchanged and used to help fund your dream home deposit?

Discover what NatWest has to offer.

Specific account criteria and terms and conditions apply. Fees may apply.